- Judith Akatugba

- 0 Comments

- 862 Views

Though it frequently goes unnoticed by investors, Africa presents a bright opportunity for anyone seeking to earn substantial returns on their capital. It is a singular opportunity in today’s investing environment.

The continent’s economic landscape is diverse, with nearly fifty countries, but many have undergone economic reforms that make them attractive for business. Despite challenges such as corruption and transparency issues, Africa provides returns on investment that are hard to find elsewhere. In the first decade of this century, African countries delivered impressive annual returns of 14%, outperforming many emerging markets.

Africa’s wealth lies in its abundant farmland and natural resources, which will only become more valuable as the global population continues to grow. With rising wages in Asia, Africa remains the last frontier of low-wage labor globally, making it a prime candidate for developing its manufacturing sector. Plus, its strategic location near North America and Europe enhances its appeal.

It’s essential to note that Africa’s diversity also extends to varying levels of risk, with some regions prospering while others struggle with corruption and instability.

In this context, six African nations shine as promising opportunities for investors seeking outstanding returns. These opportunities are waiting for those who recognize Africa’s potential and want to take advantage of them, creating profitable investments in the 21st century.

1. Nigeria

Nigerian real estate emerges as a compelling investment opportunity driven by robust growth. In 2022, the sector contributed over N28 trillion to the nation’s GDP, a testament to its economic significance. Forecasts anticipate structural reforms and consolidation of key agencies, simplifying housing development and ownership processes. Major growth hubs in 2023 encompass Lagos, Port Harcourt, Uyo, and others, with a focus on affordable housing and agro-tech development.

Investors in Nigerian real estate stand to benefit from a burgeoning market poised for expansion. As the sector thrives, the potential for returns grows, driven by urban renewal, job creation, and strategic investments. Despite challenges like production cost spikes, opportunities abound for investors seeking high-growth markets in Africa, making Nigerian real estate a shrewd choice.

2. Kenya

Kenya’s thriving real estate sector, fueled by robust infrastructure development, rapid urbanization, economic recovery post-COVID-19, and rising investor confidence, presents a compelling investment prospect. Representing 13.8% of the nation’s GDP, this sector reflects remarkable growth, positioning Kenya as a global real estate hotspot.

Looking ahead to 2024, Kenya’s real estate market promises continued expansion. Commercially, office spaces and warehousing are in high demand, with a growing preference for serviced offices and international standards. Strategic relocations of industrial parks cater to increased import-export activities. With a soaring population and an annual housing deficit of 200,000 units, the residential market, particularly in rentals, offers immense potential. Kenya’s dynamic real estate landscape offers investors resilience, growth, and opportunities, making it a shrewd choice in the African real estate arena.

3. Ghana

Investing in Ghanaian real estate is a wise decision backed by stability and growth. Ghana’s impressive Fragile State Index score of 63 underscores its commitment to democracy and the rule of law, fostering a stable political environment ideal for investors. Furthermore, the government’s effective economic policies have bolstered currency stability and reduced inflation, establishing a favorable climate for property investors and businesses alike.

Ghana’s real estate market offers compelling rental yields, ranging from 19.3% to 22.0%, ensuring attractive returns for investors. Additionally, the anticipated 74.7% inflation increase over the next five years (according to the IMF) positions real estate as a hedge against economic instability, driving capital appreciation and higher rental income. For foreign investors, the devaluation of the Ghanaian Cedi presents an opportune moment to enter the market, with favorable exchange rates making properties more affordable and rental income more rewarding in their home currency. In summary, investing in Ghanaian real estate combines stability, growth, and attractive returns—an astute choice in Africa’s flourishing property landscape.

4. South Africa

Investing in South African real estate is a strategic move, driven by several key factors. Urbanization continues to draw more people to cities, boosting the demand for well-located urban properties. Moreover, the rapid rise of smart homes, expected to be a $31.41 billion market by 2033, offers an innovative edge. Sustainable and eco-friendly building practices are also gaining ground, creating fresh investment prospects.

South Africa’s real estate landscape is undergoing a digital transformation. Virtual property tours and blockchain-based real estate tokenization are revolutionizing property transactions. Cities are even selling “sky rights” as they expand upward. However, embracing cryptocurrency as part of real estate transactions remains a challenge. These insights, combined with data, paint a compelling picture for smart investment in South African real estate.

5. Morocco

Investing in Moroccan real estate is a savvy choice, given the country’s stability, with a Fragile State Index of 70.1, and its anticipated economic growth, projected at 3% in 2023 and 3.1% in 2024. This stability, alongside a growing population, ensures a steady demand for housing, making Morocco an attractive destination for property investors. While rental yields range from 3.1% to 5.8%, indicating moderate income, the forecasted inflation rate of 12.0% over the next 5 years suggests potential property value appreciation, making early investments strategic.

Morocco’s real estate market offers an enticing proposition, driven by its economic resilience and the recovery of its robust tourism sector. Tourist arrivals and revenues have rebounded significantly, aligned with the government’s initiatives to attract more visitors, aiming for 17.5 million arrivals and the creation of 200,000 new jobs by 2026. As the country continues to thrive economically and as a tourist destination, Moroccan real estate emerges as a compelling opportunity for investors seeking stability and long-term returns in North Africa.

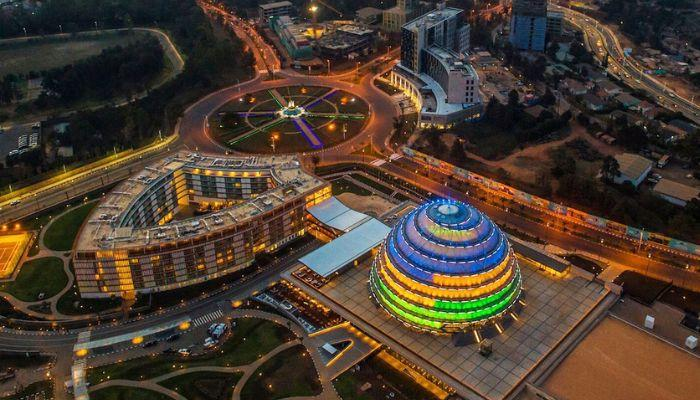

6. Rwanda

Rwanda’s real estate sector is an alluring investment opportunity, underpinned by robust statistics. The nation’s 9.2% Q1:2023 GDP growth, particularly in the services sector, underscores its economic vitality. In real estate, Q1:2023 witnessed a remarkable 9.0% growth, showcasing its potential as one of Rwanda’s fastest-growing sectors. Factors driving this progress include increasing urbanization, rising demand for housing and commercial spaces, and the government’s investments in infrastructure.

Investing in Rwandan real estate aligns with a transformative growth story. The statistics reveal a sector on the rise, bolstered by urbanization, population growth, and infrastructure development. With an anticipated decline in inflation and a strong middle class seeking quality spaces, Rwanda offers a strategic landscape for real estate investment, providing potential for attractive returns. This opportunity arises within a politically stable environment, showcasing Rwanda’s vision for economic prosperity through real estate development.