- Judith Akatugba

- 0 Comments

- 617 Views

As the most traded stock on Wall Street, chipmaker Nvidia has surpassed Tesla, further solidifying its position as the third most valued U.S. corporation and demonstrating the increasing importance of AI-related investments to investors.

Due to Nvidia’s disproportionate presence in daily stock trading, investors may be more exposed if the chipmaker’s revenue growth falls short of expectations and shatters the artificial intelligence-fueled Wall Street surge.

Read Also: How to Prepare Cajun Seafood Pasta with Scallops and Mussels

Wall Street will be watching the Santa Clara, California chipmaker’s quarterly report closely this week. The release is scheduled for this Wednesday. According to some experts, a run that has led Nvidia’s stock jumping 47% in 2024 could be reversed by anything less than a blowout report.

Over the last 30 sessions, Nvidia shares have traded for over $30 billion on average per day, outpacing the $22 billion on a daily average that Elon Musk’s electric car company had during the same period.

According to LSEG data, since 2020, Tesla has dominated daily U.S. stock trading, with turnover—the product of a stock’s share price and the number of shares traded—peaking beyond $35 billion on multiple occasions in recent years.

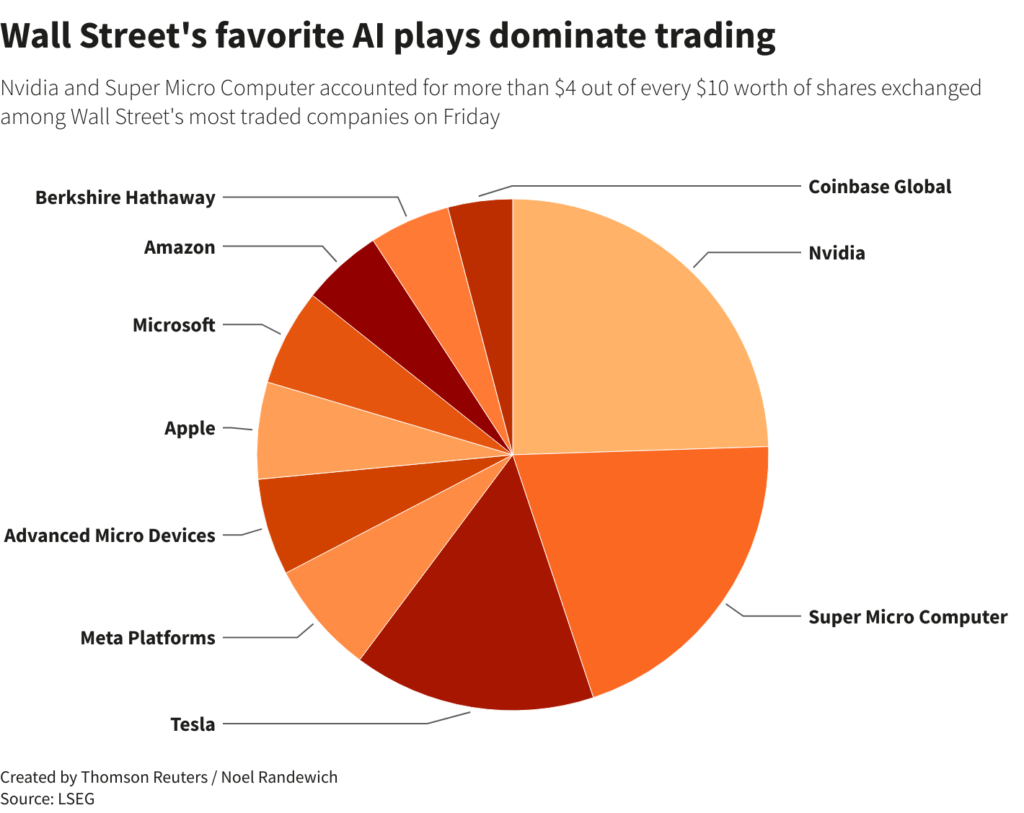

Together, trading in Nvidia and Super Micro Computer—another company reaping the rewards of artificial intelligence—accounted for more than 40% of Friday’s turnover of the top 10 U.S. equities, which also included Tesla, Meta Platforms, Apple, Amazon, and Microsoft.

Dennis Dick, a trader with Triple D Trading in Ontario, Canada, stated, “There’s an argument here that this is the dawn of a new era of trading, like the dawn of the internet.”

However, Dick also issued a warning, pointing out that the extraordinarily high turnover in AI-related equities indicates algorithmic traders and regular investors are pushing share prices up on momentum rather than fundamentals like projected future revenue growth.

Super Micro, whose worth has more than tripled to $45 billion as of 2024, is a vendor to Nvidia for AI-related server components. It fell 20% from its all-time highs on Friday following the announcement by Wells Fargo that it was now rated as equal weight and that its valuation already discounted “solid upside”.

About 80% of the market for high-end AI chips is controlled by Nvidia, which last week overtook Amazon and Alphabet in terms of market valuation to rank third on Wall Street behind Apple and Microsoft. The value of Nvidia’s stock on the market jumped from $540 billion to $1.8 trillion in just one year.

Meanwhile, as it battles with waning demand for its electric vehicles and escalating competition, Tesla’s stock has fallen 20% so far in 2024.